Srinagar, Bandipora, Kupwara, and Ganderbal rank at the bottom in access; Bandipora and Anantnag fall behind in savings accounts

Srinagar, Dec 04 :

The Reserve Bank of India’s (RBI) Financial Inclusion Index-2025 has revealed key gaps in access and usage of banking facilities in different districts of the Kashmir Valley.

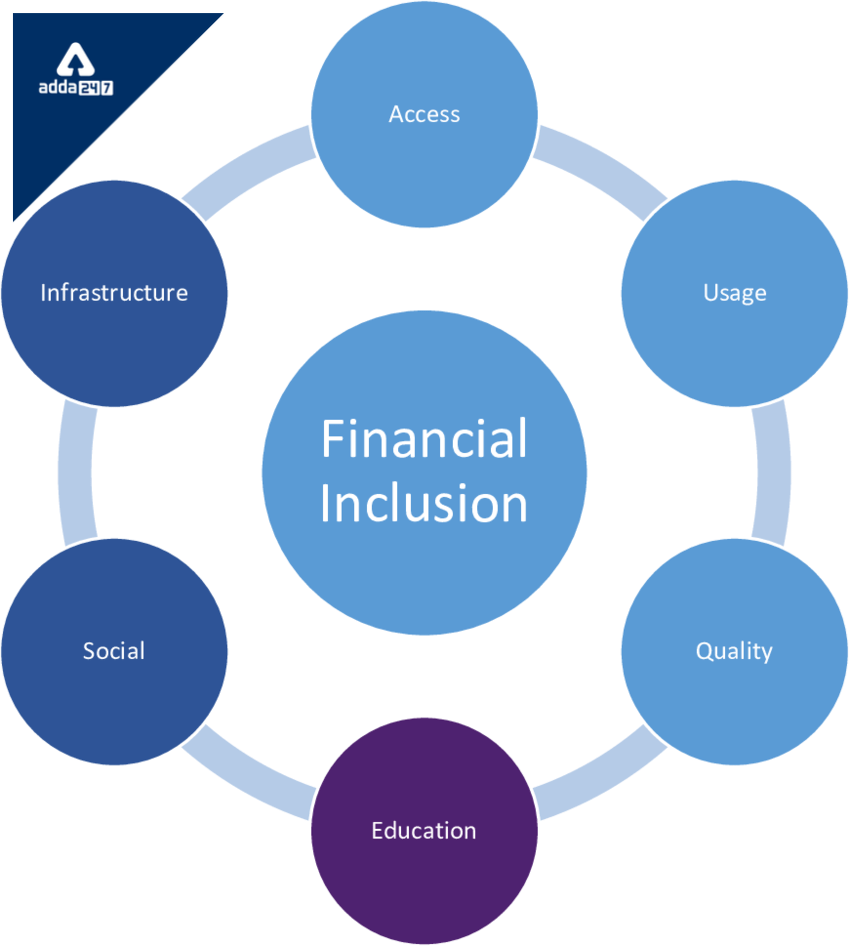

The RBI’s Financial Inclusion Index measures financial inclusion across three key parameters: Access (35%), Usage (45%), and Quality (20%).

According to details available with news agency—Kashmir News Observer (KNO), four districts of the Union Territory of J&K fall in the bottom 10 percentile under the Access parameter (branches, fixed business correspondents, and automated teller machines).

The four districts- Srinagar, Bandipora, Kupwara, and Ganderbal- fall in the bottom 10 percentile for the ‘fixed business correspondent’ indicator.

Similarly, under the usage parameter, Bandipora and Anantnag districts were placed in the bottom 10 percentile for the “number of savings accounts” indicator.

The issue of these gaps also came under discussion during the 17th Union Territory Level Bankers’ Committee (UTLBC) meeting chaired by Chief Secretary Atal Dulloo on Saturday in Srinagar, to review the performance of banks and financial institutions operating in the Union Territory—(KNO)